Bear Market Strategies

If we are not in a bear market yet, we're getting pretty close. The definition is a 20% downturn or more over at least a two-month period of time.

There is nothing pleasant about a bear market—not the anxieties they cause, not the paper losses, not the relentless drip, drip, drip of reports in the media about this or that daily downturn. The gut instinct is to stem the losses by selling before the market goes down further, but locking in losses after the fact has, historically, almost always been the wrong move. Nevertheless, many people do it, and sell to wiser investors who prefer buying their investments on sale.

There is a saying on Wall Street to the effect that, during bear markets, investments tend to return to their rightful owners.

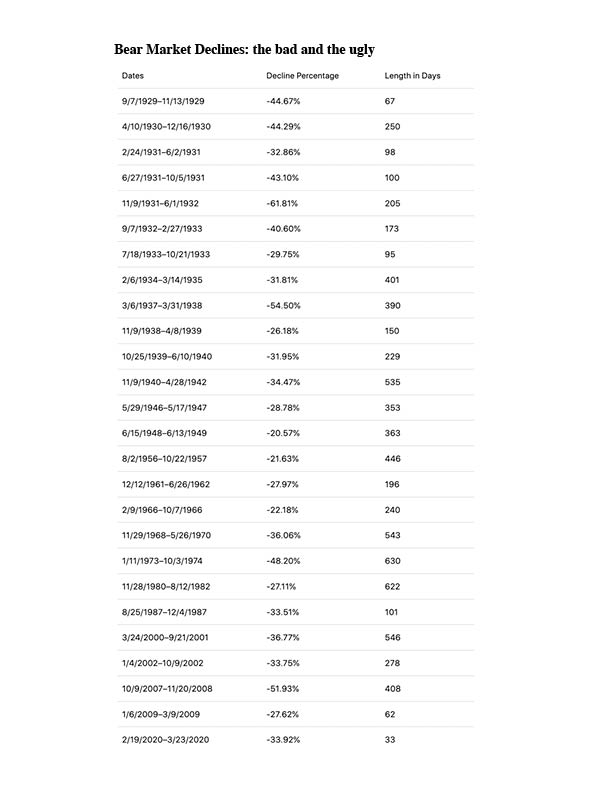

What is often lost in the market punditry and gloomy daily reports is how common bear markets have actually been in market history. Since 1929, there have been 28 downturns that met the technical definition of a bear market, or roughly one every 3.3 years. The 2007-8 downturn was a whopper; the markets lost just under 52% of their value before roaring back into one of the greatest, most intense bull markets in history. The short Covid-related downturn in 2020 was one of the quickest, lasting just 33 days before recovery.

Perhaps the hardest part of these sharp market declines is staying disciplined, and the hardest part of the discipline is rebalancing. Rebalancing, of course, takes place periodically, sometimes opportunistically, where the target mix of stocks , bonds and other asset classes becomes distorted. Bear markets distort the mix by reducing the percentage of stocks according to their reduced prices, and the disciplined action is to buy more stocks to compensate and return to the original allocations.

But buy stocks when the market is tanking? What kind of insanity is that?

Disciplined rebalancing has historically generated the best results during market downturns, when you’re adding risk assets (stocks, primarily) at a time when they’re on sale, at some point before the next recovery has started kicking in. It can also be beneficial when the markets have been rising; you sell risk assets when they’re unusually pricey.

Bear markets are also an opportunity to share some of your pain with the government. You do this by ‘harvesting’ losses in the portfolio, which can be used to offset income or portfolio gains. Normally, the position with a loss is sold, the loss can be used to reduce what you pay in taxes, you buy a similar (but not identical) asset so you’re not missing any market recovery, and after 61 days have passed you repurchase the original asset.

These are activities that can make you money during downturns, but one must admit that they aren’t fun, and in some cases they directly contradict what your instincts might be telling you to do.

It might help to remember that your instincts were honed over hundreds of thousands of years, to optimize your brain to recognize the right time to stalk a herd of antelope or dig dwarf yams out of the ground. It may take a few more hundreds of thousands of years before our brains are optimized to stalk better stock market returns.

Sources:

https://seekingalpha.com/article/4483348-bear-market-history

https://www.firstrade.com/content/en-us/accounts/taxcenter/?